If you use this automatic 2-month extension, you must attach a statement to your return explaining which of the two situations qualify you for the extension. In military or naval service on duty outside of the United States and Puerto Rico.įor additional information, refer to Publication 54, Tax Guide for U.S.Living outside of the United States and Puerto Rico, and your main place of business or post of duty is outside of the United States and Puerto Rico, or.citizen or resident alien, and on the regular due date of your return you're either: Out of the Country – You're allowed two extra months (generally until June 15) to file your return and pay any tax due without requesting an extension if you're a U.S. Several companies offer free filing of Form 4868 through the Free File program.

#Filing irss form 4868 software

You should refer to your tax software or tax professional for ways to file and pay electronically using e-file services. Once you file, you'll receive an electronic acknowledgement that the IRS has accepted your filing.

#Filing irss form 4868 verification

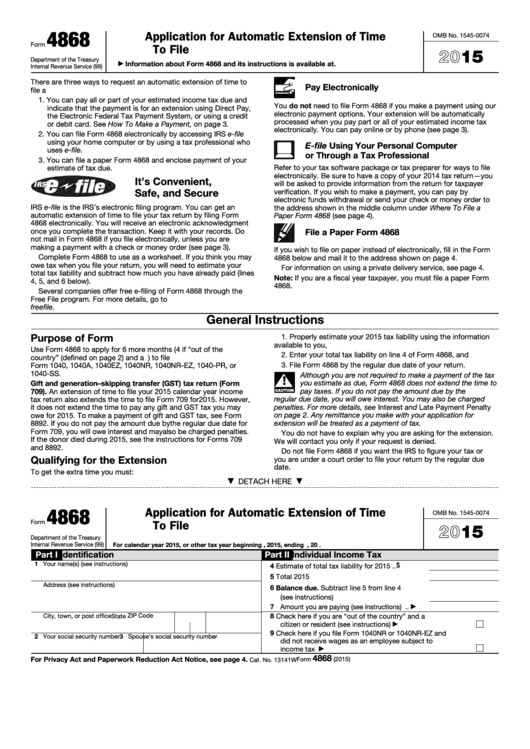

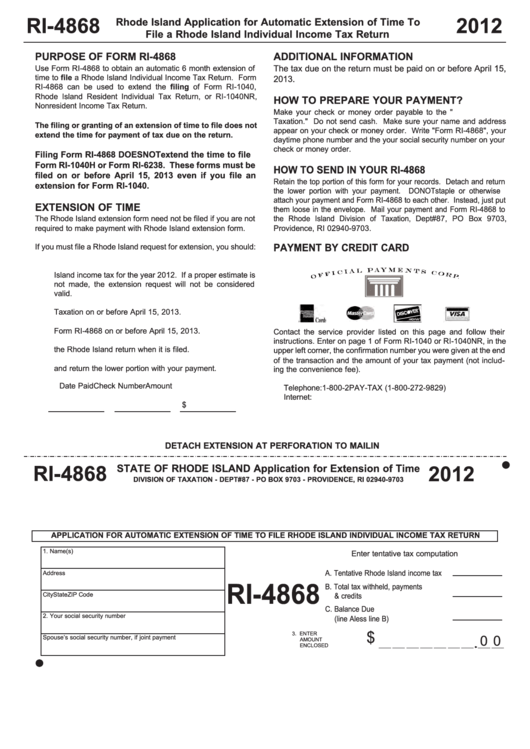

If you file the Form 4868 electronically, be sure to have a copy of your prior year's return you'll be asked to provide your prior year's adjusted gross income (AGI) amount for verification purposes. Note: Fiscal year taxpayers may file extensions only by filing a paper Form 4868. Individual Income Tax Return using your personal computer or through a tax professional who uses e-file. E-file Form 4868, Application for Automatic Extension of Time To File U.S.You'll receive a confirmation number for your records. Pay all or part of your estimated income tax due and indicate that the payment is for an extension using IRS Direct Pay, EFTPS: The Electronic Federal Tax Payment System, a debit or credit card.You may file your extension in any one of three ways listed below:

An extension of time to file is not an extension of time to pay. You must request the extension of time to file by the regular due date of your return to avoid the penalty for filing late. There are three ways to request an automatic extension of time to file your return. You may request up to an additional 6 months to file your U.S.

0 kommentar(er)

0 kommentar(er)